The concept

The 10-year Treasury bond yield is the interest rate that the U.S. government pays to borrow money for a decade. It serves as a benchmark for other interest rates and also a key indicator of investor sentiment about economic conditions.

The math

A bond’s yield is determined by dividing its annual interest payment by its current price. There is thus an inverse relationship between bond yield and prices (E.g when a bond's price falls, its yield rises because the annual interest payment remains the same).

The U.S Treasury sells bonds via auction and yields are set through a bidding process. When confidence is low, bond prices rise and yields fall as there is more demand for this safe investment. Conversely, a rising yield indicates falling demand for Treasury bonds.

The situation

The 10-year yield has generally been decreasing this year in 2024 in response to the Fed cutting its short-term rates - the Fed has lowered by 75 basis points this year with further cuts expected in coming months, easing their monetary policy as they view supporting employment becoming at least as much of a priority as reducing inflation. The market prices the 10-year to be what it expects the average Fed rate will be over the next 10 years. Thus long yields should follow short yields. There was also a recession scare in July/August which drove the rates way down (remember, low consumer confidence = higher demand for bonds as a safe investment).

Yet if you observe the original chart above, you’ll notice that the 10-year yield has been rising over the past month. Why is that so?

The main argument is inflation expectations. The market believes that a Trump-led administration will turbo-juice the US economy on debt and bring about strong economic growth as well as inflation. Summers, a famed economist, commented this week that Trump’s policies could bring about an inflation crisis that is greater than the last one.

Whatever the Fed is doing in the short term doesn’t matter, if they end up reversing course in a year to combat inflation again. There are already signs of this with Fed chair Powell recently suggesting that a cut in December may not be necessary. So if you expect future inflation to be higher, you would not want to make a long-term loan at a relatively lower rate as higher inflation would eat into that interest in the future.

Furthermore, if the U.S is to increase their spending to fund Trumps’ pro-growth policies, then there will also likely be a higher supply of long term bonds, which will further reduce bond prices.

The yield curve

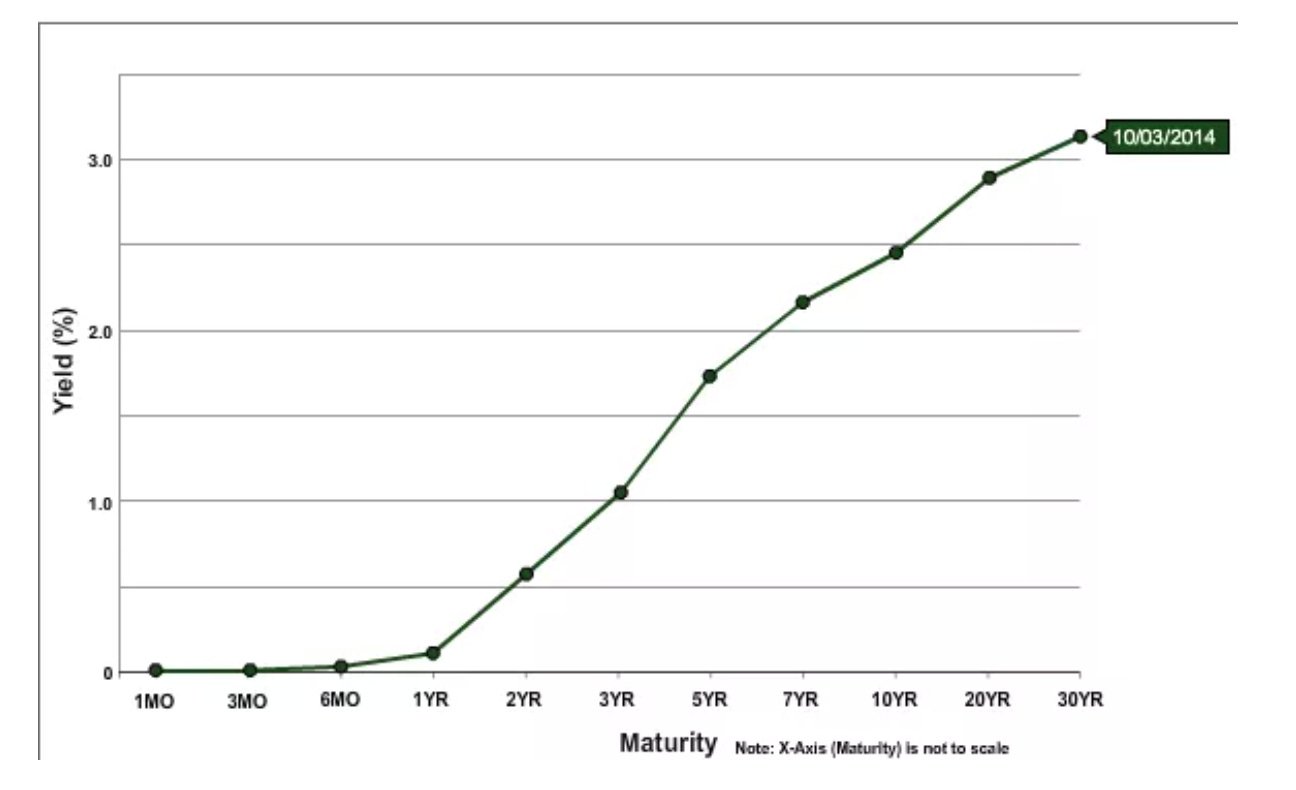

A side note here about the yield curve as you may have heard about that term! The Treasury yield curve shows the yields for Treasury securities of different maturities. It reflects market expectations of future interest rate fluctuations over varying periods of time.

The yield curve shape above is considered normal because it slopes upward with a concave slope, as the borrowing period, or bond maturity, extends into the future. The scenario is considered normal because investors are compensated for holding longer-term securities, which possess greater investment risks.

You may have also heard of an inverted yield curve. An inverted yield curve slopes downward with short-term interest rates exceeding long-term rates. This type of curve corresponds to a period of economic recession as investors expect yields on longer-maturity bonds to trend lower in the future. They tend to choose longer-dated bonds over short-dated bonds, bidding up the price of longer bonds and driving down their yield.

That’s enough bond yield concepts for this week. My takeaway is that the 10-year yield can be used as a signal of market expectations around inflation and recession. It does not necessarily follow short-term rates.

This Week:

🇺🇸: Trump has named some members of his new administration, including Marco Rubio as secretary of state, Elon Musk and Vivek Ramaswamy in the Department of Governmental Efficiency (DOGE) and RFK Jr for Health and Human services.

🇺🇸: The FED does not need to rush to lower interest rates according to Jerome Powell, as inflation remains above their 2% target while economic growth and the job market remains strong. Traders still expect the Fed to cut interest rates by 25 basis points in Dec, but there is more uncertainty now, as reflected in the pull-back in prices of rate-sensitive assets.

💰: Bytedance values itself at US$400 billion in a recent buyback offer. It remains to be seen whether the chinese company will be forced to divest / take down Tiktok in the U.S, following Trump’s election victory.

🇦🇷: Argentina’s inflation slowed to 2.7% in October, the lowest level in three years in a win for Javier Milei’s fight against Argentina’s worst economic crisis in over two decades.

🇸🇬: Grab reported strong Q3 earnings with 17% YoY revenue growth and EBITDA of US$90 million (224% YoY) as the stock price surged 12%.