My attempt at kickstarting this newsletter coincided with one of the most important weeks for the financial markets.

Donald Trump re-elected

This past Wednesday, the world collectively watched a red wave swept over the electoral college map as Donald Trump’s victory over Kamala Harris means that he will start his term as U.S.’s 47th president in January 2025.

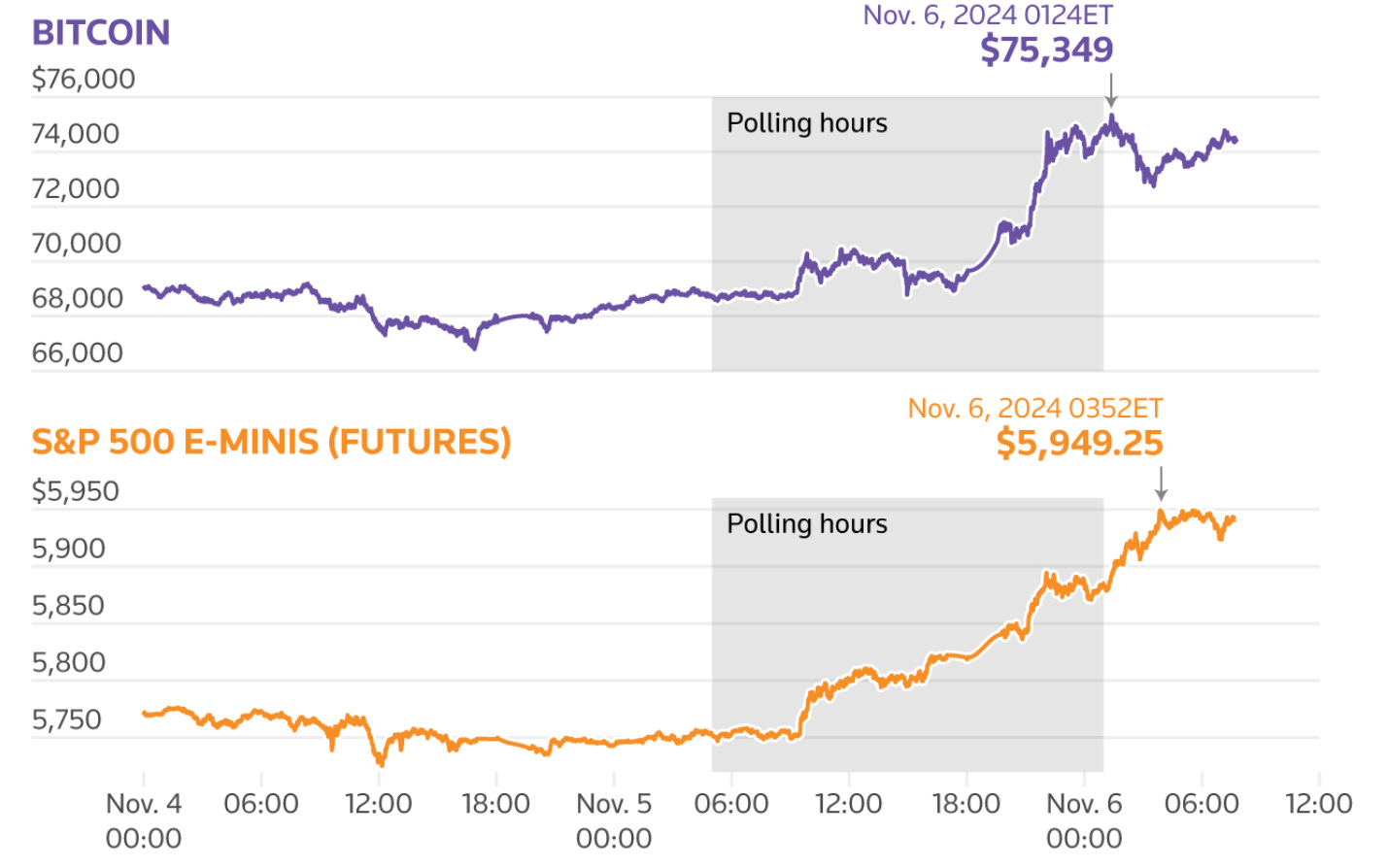

It will be interesting to watch how his second term unfolds. There was immediate reaction in the markets with Bitcoin up ~10% and S&P up >2% as most U.S stocks rallied sharply, including Tesla (14%) and Coinbase (31%).

This rally can be attributed to (a) the dominance of Trump’s victory which removed any potential uncertainty surrounding the election results and (b) his policies which are perceived to be favourable to risk-on assets and cryptocurrency. Here’s a recap of some of the key policies he campaigned on:

Immigration: Trump has made the deportation of unauthorised immigrants one of his top priority.

Taxes: Trump’s policies generally favours corporations and wealthier Americans, including the intention to cut corporate tax rates.

Tariffs: In a nationalistic move, Trump has called for a 20% import tariff, a 60% duty on Chinese goods, and a punitive tax on U.S. companies that ship jobs overseas.

Climate and energy: The man who believes climate change is a hoax has pledged to cut back on incentives related to clean energy such as EV credits.

Crypto: This election cycle, Trump has been pro-cryptocurrencies, promising to build a Bitcoin reserve and replace SEC chair Gary Gensler (who is seen as unfriendly towards cryptocurrencies).

De-regulation: In general, Trump is a de-regulator and this is favourable for industries that have been clouded by regulatory uncertainty.

You should also keep an eye out for who Trump engages to be part of his new cabinet - Elon Musk and RFK Jr are among some of the high-profile names that have been heavily involved in his campaign. His selections will most certainly have downstream implications - Musk for example, should be expected to have vested interests in policies that favour his companies (Tesla, SpaceX etc).

As Trump’s second administration looms closer, some things seem certain to me. Lower tax rates and de-regulation will fuel greater economic activities and M&A. This, coupled with stricter immigration policies that affects labour supply, will in turn fuel inflation. And lastly, cryptocurrencies (especially Bitcoin) looks set to be a huge beneficiary especially if the U.S. is to be a net-buyer of Bitcoin.

Personally, I have re-allocated my portfolio to increase my Bitcoin exposure post-election. What moves are you making, if any?

This Week:

🇺🇸: Fed cuts rates by 25bp as expected, and Powell said that he has no intention to resign if asked by Trump.

💰: A French trader “Theo” made $85 million from his bets on Trump’s election victory on Polymarket, the site that rose to prominence this election cycle for enabling election betting via blockchain.

🇮🇳: Swiggy’s IPO was oversubscribed as it gears up to debut on stock exchanges next week. The loss-making firm is India’s second biggest player in a duopolistic food delivery and quick-commerce sector shared with Zomato. In contrast to other countries, India has had a buoyant IPO market this year.