Primer: Asset Tokenisation

Before we dive specifically into Stablecoins, it’s important to understand the fundamental concept of asset tokenisation. This refers to the act of creating digital representations (tokens) of financial assets. These tokens represents partial or full ownership / right to the underlying assets which can be physical or financial in nature.

In theory, the underlying assets should be held by a custodian while the tokens are distributed to investors who then trade these on a secondary market, with transfers and verifications facilitated by blockchain technology, maintaining an immutable and transparent record of all transactions.

Now moving on to Stablecoins…

The need for a stable blockchain currency

To serve as a medium of exchange for blockchain transactions, a currency needs to maintain stability to assure recipients that the currency will retain its purchasing power in the short term, just like the physical dollar in the real world. This makes the most famous cryptocurrencies such as Bitcoin and Ether unsuitable as tokens to facilitate transactions and store value, given their high price volatility.

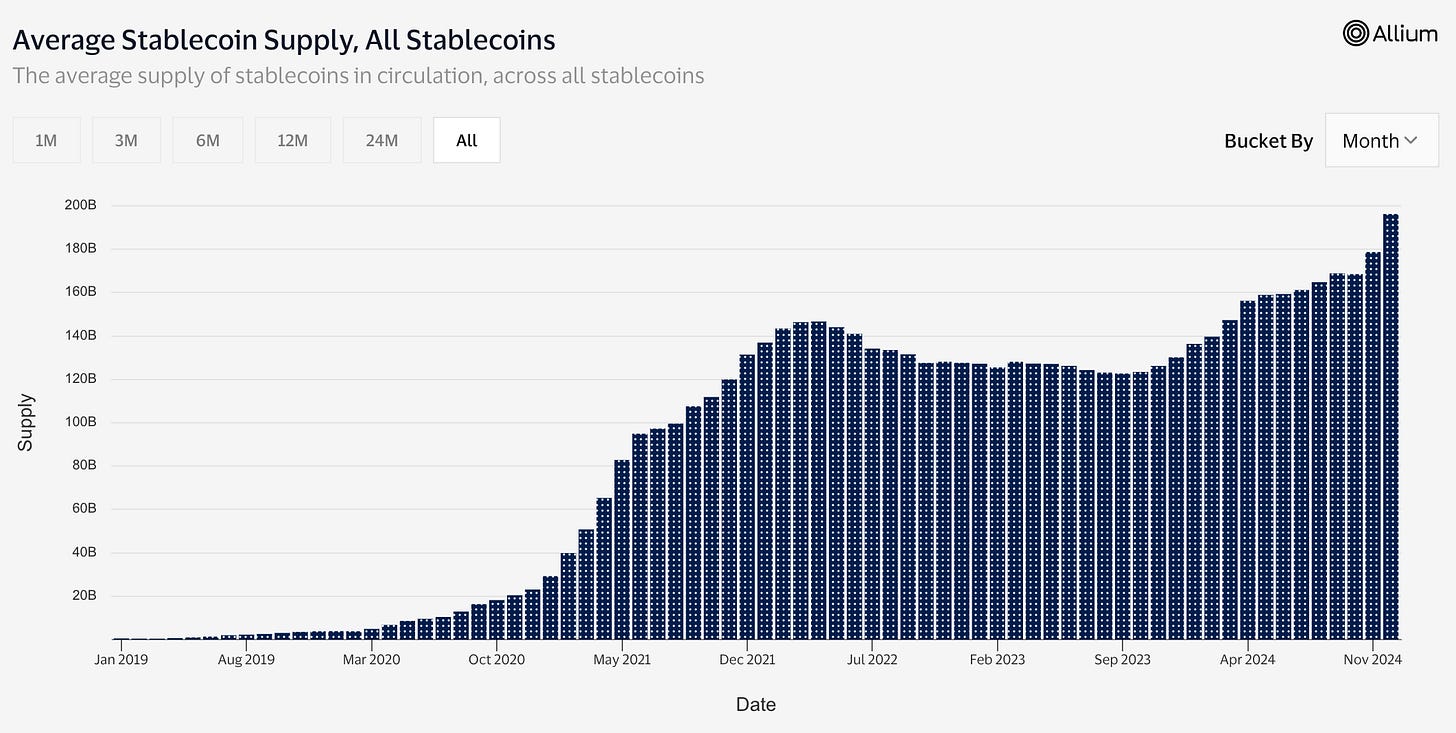

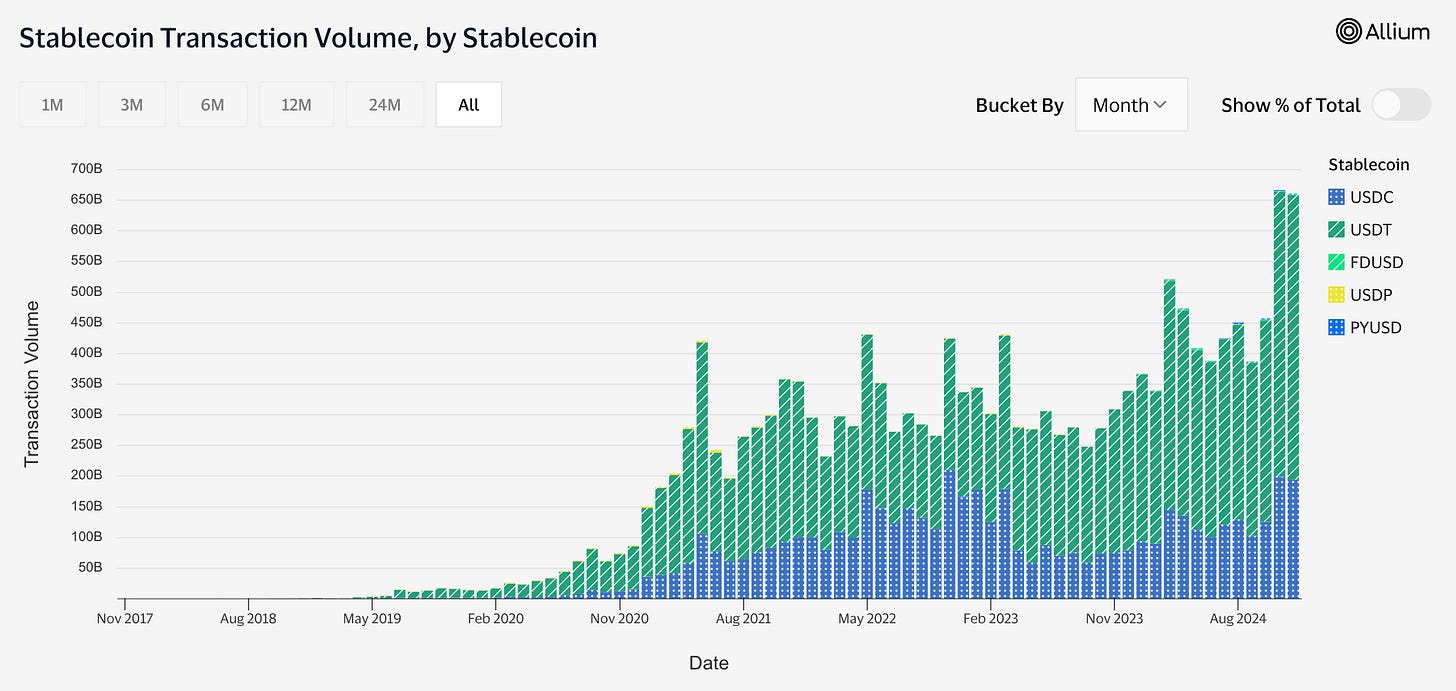

Stablecoins are a class of cryptocurrencies designed to maintain a stable value to serve this purpose. The top Stablecoins today are USDT (issued by Tether) and USDC (issued by Circle), powering over $25.9T in total transaction volume over the last 12 months, with around $196B in circulation as of Dec’24, according to Visa.

How Stablecoins work

Stablecoins maintain their stability in a few ways:

Fiat-backed Stablecoins maintain a reserve of a fiat currency (or currencies) such as the U.S. dollar as collateral. This means that in theory, every dollar of a stablecoin issued and circulated is backed by an actual fiat dollar held in a custodian.

Commodity-backed Stablecoins function similarly to fiat-backed stablecoins, but instead they are pegged to the market value of commodities such as gold, silver, or oil.

Crypto-backed Stablecoins are backed by other cryptocurrencies. Given the high volatility of the reserve, such stablecoins are generally overcollateralised i.e the reserve value exceeds the value of the stablecoins issued to insure against a X% decline in the price of the reserve cryptocurrency

Algorithmic Stablecoins control their supply through an algorithm that often involves creating and destroying tokens based on market demand and supply, instead of backing them with any alternative assets. The infamous Luna and UST is an example of this:

Arbitrageurs would help to keep the price of UST in check. If, for example, UST slipped to $0.95, traders can buy a bunch at that price but swap it for $1 of LUNA. In doing so, UST supply is reduced and, therefore, the price theoretically heads back up.

Business Model

If a centralised currency maintains a stable value over time, how does the company behind it make money? One way is to charge fees for issuing these tokens, but that’s a small pie.

The main revenue stream is to earn interest on the reserve assets that back the Stablecoin. Much like a bank, a company like Tether or Circle can generate substantial interest income. This has proven to be a great business, because as adoption of crypto grows and the demand for Stablecoin increases over time to facilitate more transactions, these companies can just issue more tokens and receive more deposits to earn more interest income.

This may be why even traditional fintech companies like Paypal have joined the party in issuing their own stablecoin - Paypal’s recently-launched PYUSD already has over $1B in supply to date. Meanwhile, Visa announced their platform solution for banks to issue their own fiat-backed tokens including stablecoins, while other fintech companies like Revolut and Robinhood are reportedly also considering launching stablecoins of their own. Payment processing company Stripe allows merchants in the US to accept payments via USDC, and is reportedly in talks to acquire stablecoin-focused platform Bridge.

The Risk

Now imagine you own a company that issues Stablecoin, but you’re a bad actor trying to take on more leverage to earn more revenue, what would you do?

You could take customers’ deposits and use them to issue loans or invest in other asset classes instead of buying the fiat dollars and holding them safely in a custodian account as you publicly committed to. This means that your stablecoin may not actually be backed dollar-to-dollar by a fiat currency, exposing end users (or exchanges) to a bank-run type of risk.

For example, Tether, with over $100B of USDT in circulation, has yet to provide conclusive evidence of full reserve backing in the face of regulatory pressures, fuelling concerns over the impact on financial markets if it fails one day.

Have Stablecoins grown so much in importance that they now represent a systemic risk in crypto as well as the wider financial markets? It remains to be seen if these fiat-backed Stablecoins can withstand rapid outflows when such a day comes. It’s a matter of when, not if.

-

This week…

🇺🇲: Palantir, Anduril, SpaceX, OpenAI and more are in talks to form a consortium that will jointly bid for US government work in an effort to disrupt the country’s oligopoly of traditional “prime” contractors such as Lockheed Martin, Raytheon and Boeing

🇺🇲: Trump names 5 picks for Pentagon jobs, including billionaire private equity investor Stephen Feinberg

With the recent delisting of Tether’s USDL from many exchanges due to MiCA non-compliance coupled with the global compliance of Ripple’s RLUSD as the new US stablecoin we will be seeing some major changes during 2025.